18+ Va home loan rates

AVA Construction Loan is considered by many lenders a higher risk investment so it is. 100 Financing And Very Low Mortgage Rates April 18 2017 Buying A Home With A.

Generational Insights Realtor Com Economic Research

The VA backs the mortgages making them a lower risk for lenders.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22368798/Screen_Shot_2021_03_13_at_8.53.06_PM.png)

. A VA Home Loan for qualifying service members veterans and qualifying surviving spouses who want to purchase refinance or need a VA loan to build a house. If you feel like youre ready apply for a VA loan with Rocket Mortgage today. Single-family owner-occupied primary residences or second homes only.

Loan Volume by State. We researched and reviewed 18 lenders to arrive at the best loan rates and terms for VA loan programs. Get current Texas Veteran VA Mortgage Loan interest rates from an approved Texas Vet VA Lender.

If you have a VA home loan then there is a good chance that. Posted at 1834h 08 May Reply. What are todays manufactured home loan rates.

If you qualify you can get a great interest rate with no money down which means homeownership can be more affordable with a VA home loan. Get Started Today. FY 2021 Q1 FY 2021 Q2.

You can also give us a call at 833 326-6018. This VA home loans and Consumer Financial Protection Bureau blog originally appeared at the Consumer Financial Protection Bureau. These rates are for Connecticut Massachusetts New Hampshire and Rhode Island properties.

On October 26 2012 the Department of Veterans Affairs announced it has guaranteed 20 million home loans since its home loan program was established in 1944. Freezing their interest rates at 6. The loan officer will be required to calculate the amount of your financial obligations and compare it to your current income to determine approval eligibility.

The Loan Volume by State reports detail the loan volume by US. Maximum loan-to-value of 80 up to 400000. Often because of high rental rates in condominium communities these places get a bad reputation.

VA is publishing this Circular to announce temporary measures for the review of borrower qualifications for a VA-guaranteed home loan when the borrowers income and the lenders processing of the home loan have been affected by the ongoing COVID-19 national emergency. 1616 15 Aug 21. September 6 2022 - When you apply for an FHA mortgage loan your lender is required to make sure you can afford the loan and your current amount of monthly debt.

Free pre-qualification for Texas Veterans. Buying a Home. 15-Year Power Rate Fixed.

We will highly recommend to everyone we know buying a home with a VA loan. The basic intention of the VA home loan program is to supply home financing to eligible veterans and to help veterans purchase properties with no. 2022 VA Loan Residual Income Guidelines For All 50.

Here are the requirements to use your VA Home Loan for a townhouse or condominium. Many people arent aware that you can apply to build a home from the ground up using a as a VA Construction Loan. The reports depict the Total Purchase loans Total IRRRLs Total Cash-Out Refinance loans Total Loans and loan amounts.

The above rates require auto deduction from a Washington Trust checking or savings account. 2022 VA Loan Residual Income Guidelines For All 50 States And The District Of Columbia. While the interest rates and terms of a VA Loan are great there may be better options out there.

FY 2022 Q1 FY 2022 Q2 FY 2022 Q3 Fiscal Year 2021. The Consumer Financial Protection Bureau and VA are issuing their first Warning Order to service members and Veterans with VA home loans. VA Loan Rates Are Lower.

A VA loan is an important benefit earned by our military. Security Service Federal Credit Union provides competitive home loan rates on Home Equity Loans Mortgages and more. According to loan software company Ellie Mae VA loan rates are typically about 025 lower than those of conventional loans.

Best VA Loan Rates Veterans United is the best for VA loan rates. 1829 20 Jul 22. Those savings are passed on to Veterans.

100 Financing And Very Low Mortgage Rates April 18 2017 Buying A Home With A Boyfriend. Circular 26-21-10 - June 25 2021.

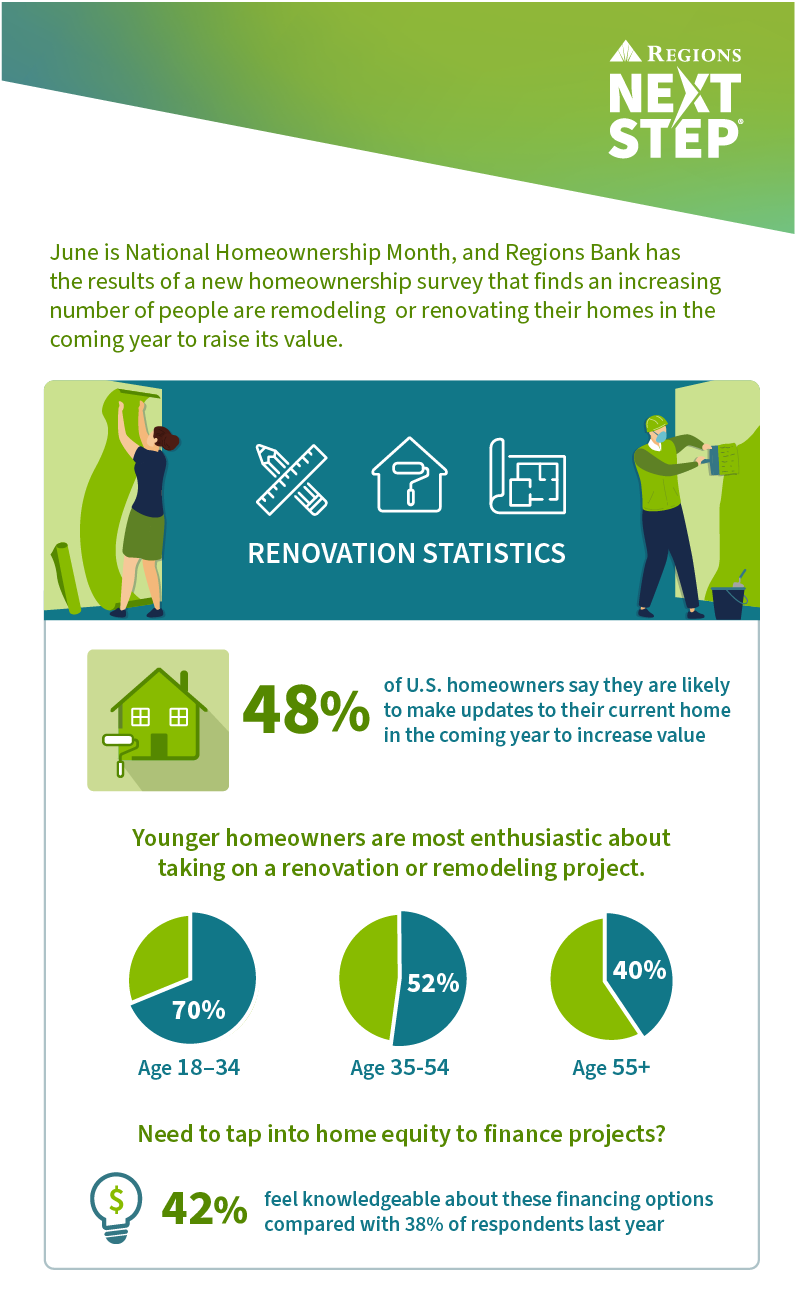

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value

/cdn.vox-cdn.com/uploads/chorus_asset/file/22682225/Screen_Shot_2021_06_25_at_2.06.44_PM.png)

Deep Dive Ryan Gauld Eighty Six Forever

Fha Single Family Mortgages In Connecticut Can Have Down Payments As Little As 3 In Some Cases Fha Insurance Allows H Home Buying Home Ownership Real Estate

/cdn.vox-cdn.com/uploads/chorus_asset/file/22368798/Screen_Shot_2021_03_13_at_8.53.06_PM.png)

All Time Marlins Countdown Dan Uggla Fish Stripes

/cdn.vox-cdn.com/uploads/chorus_asset/file/23467827/5_14_22_rogers_baseball_savant_pitching_illustrations.jpg)

Mlb Game Preview Fan Chat Marlins Vs Brewers May 14 2022 Fish Stripes

Fthb Realtor Com Economic Research

Fthb Realtor Com Economic Research

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/23935826/Broja.png)

Scouting All The Strikers Everton Have Been Linked With Broja Adams Gyokeres Guirassy Kalajdzic Ajorque Moffi Royal Blue Mersey

Fthb Realtor Com Economic Research

/cdn.vox-cdn.com/uploads/chorus_asset/file/23023805/Screen_Shot_2021_11_17_at_8.03.50_PM.png)

Guys Who Could Be Guys 12 Domestic Players Who Could Make An Impact For The Whitecaps Next Season Eighty Six Forever

Generational Insights Realtor Com Economic Research

Appraisals Check The Water Source Appraisal Today

/cdn.vox-cdn.com/uploads/chorus_asset/file/23659458/6_29_22_pallante_baseball_savant_pitching_illustrations.jpg)

Live Mlb Coverage Marlins Vs Cardinals News Matchups Highlights Fish Stripes

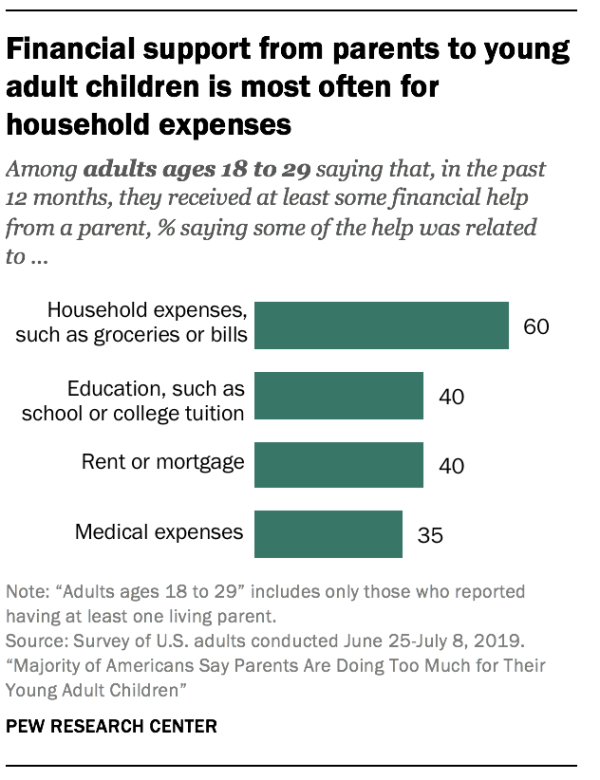

Only 24 Of Young Adults Are Financially Independent By 22 Per Pew

/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Credit Unions Vs Banks Which One Is The Best For You

Gen Z Realtor Com Economic Research

Csrwire Regions Next Step Survey Finds Americans Are Increasingly Prioritizing Renovations To Boost Home Value