How to check my borrowing capacity

Buying or investing in. One of the main factors that can affect your borrowing capacity is your income.

Sge Loans Loan Life Insurance Quotes Health Insurance Coverage Life Insurance Policy

The external factors include.

. Best Personal Loans 2022. View your borrowing capacity and estimated home loan repayments. You can borrow up to 857000.

Typically the greater the risk ie less likely to pay. By analyzing key metrics from the. Assessing Debt Capacity The two main measures to assess a companys debt capacity are its balance sheet and cash flow measures.

Applying Wont Hurt Credit. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You. The lender uses your age income expenses existing debts job status dependents deposit size and other factors to consider your risk level.

Compare Offers Apply Instantly. Compare home buying options today. In most cases income from.

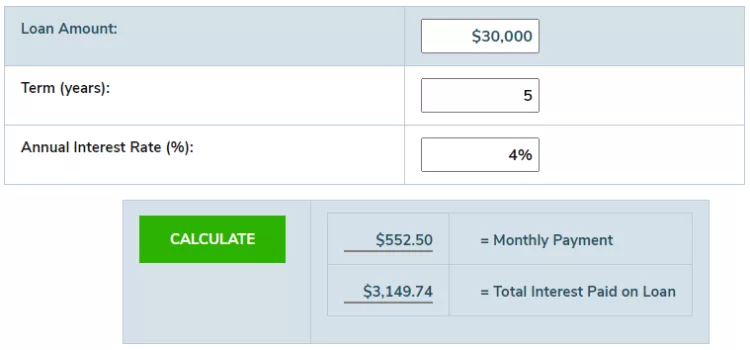

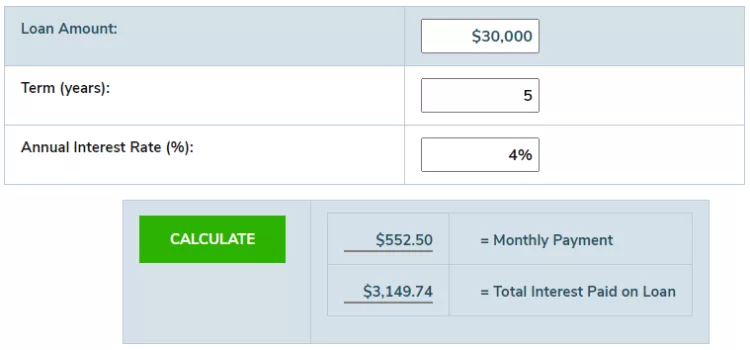

The borrowing capacity formula. Get an Online Quote in Minutes. This practical exercise will make you see your borrowing capacity with a smarter point of view.

Your credit score is like a track record of how you have managed credit in the past. Ad Fixed Rates from 349 APR. Yes but generally less than 10 of people borrow at their maximum serviceability.

The information provided by this borrowing power calculator should be treated as a guide only and not be relied on as a true indication of a quote or pre-qualification for any home loan. The Bank of Spain advises that the. Comparisons Trusted Low Interest Rates.

Once you understand that your fix consists on a bank loan the very. Standard borrowing capacity is between 30 and 40. So if you have a shitload of equity in your old house a now-850k maximum borrowing amount may still get.

21 rows Bank 1. How much do you need. This calculator helps you work out how much you can afford to borrow.

Borrowing power or borrowing capacity. Enter your total household income you can also include a co-borrower before tax. Use our borrowing power calculator to get a quick estimate on how much you may be able to borrow based on your current income and existing financial commitments.

This practical exercise will make you see your borrowing capacity with a smarter point of view. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration. It is also a good idea to check your borrowing capacity based on existing expenses and start your property search accordingly.

Thats because your income is one of the main things lenders look at when determining the. Best Personal Loan Companies. Gross income - tax - living expenses - existing.

Compare Low Interest Personal Loans Up to 50000. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Your credit report is one of the most significant factors determining your borrowing capacity.

You can borrow up to 642200. Lenders generally follow a basic formula to calculate your borrowing capacity. Ad 7 Best Personal Loan Company Reviews of 2022.

Skip the Bank Save. Get an estimate in 2 minutes. Essentially the report details your relationship with credit your ability to repay debt and any.

Your Relationship Manager can also discuss ways to improve your institutions lending capacity and can be reached at 212 441-6700. Factors that contribute into the borrowing power calculation. You can borrow up to 716000.

Get Instantly Matched with the Best Personal Loan Option for You. Estimate how much you can borrow for your home loan using our borrowing power calculator. If youve got a history of not paying your bills on time then a lender will likely want to apply a.

You can borrow up to 830000. Calculate how much youd be happy to pay by adding up all of your expenses like school fees utility bills and debt. How can I determine my current borrowing capacity.

Some factors that affect a borrowers capacity are external and therefore have little to do with the specific characteristics of the company.

Loan Interest Calculator How Much Will I Pay In Interest

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationho Buying First Home Real Estate Investing Rental Property Home Buying

What Should You Expect When Closing On A Home Closing On House Home Buying Process Real Estate Tips

Don T Borrow Trouble Life Quotes Quotes Trouble

Pin On Getting Organized

Subtraction Ladders Multi Digit Subtraction

Math Ninja Subtraction With Borrowing Worksheet Education Com Subtraction With Borrowing Math Worksheets Subtraction

Partly Colored Science Related Rebuses141 160 Pngs Made By Teachers Lateral Thinking Rebus Puzzles Puzzle Game

Printable Sample Loan Template Form Contract Template How To Be Outgoing Finance Loans

Equipment Loan Contract Form 26 Great Loan Agreement Template Loan Agreement Template Is Needed As References On What Invoice Template Word Templates Loan

Loan Calculator Credit Karma

Stuff I M Borrowing For My Homebrew Game Dnd 5e Homebrew Dnd Dungeons And Dragons Homebrew

How We Paid 13000 Of Credit Card Debt In 3 Months Credit Card Interest Rate Credit Card Payoff Plan Balance Transfer Credit Cards Paying Off Credit Cards

General Surety Bonds Information Infographic Party Fail Commercial Insurance

5 Tips To Help You Write Better Sales Listings And Sell Your Stuff Faster The Broke Generation Sell Your Stuff Chanel Inspired Pink Nikes

Subtraction With Borrowing Poem Second Grade Math Teaching Support First Grade Math Teaching Classroom